How to Read “Both ends meet”

Both ends meet

[bohth endz meet]

This phrase is straightforward to pronounce with common English words.

Meaning of “Both ends meet”

Simply put, this proverb means managing to balance your money so you have enough to cover your expenses.

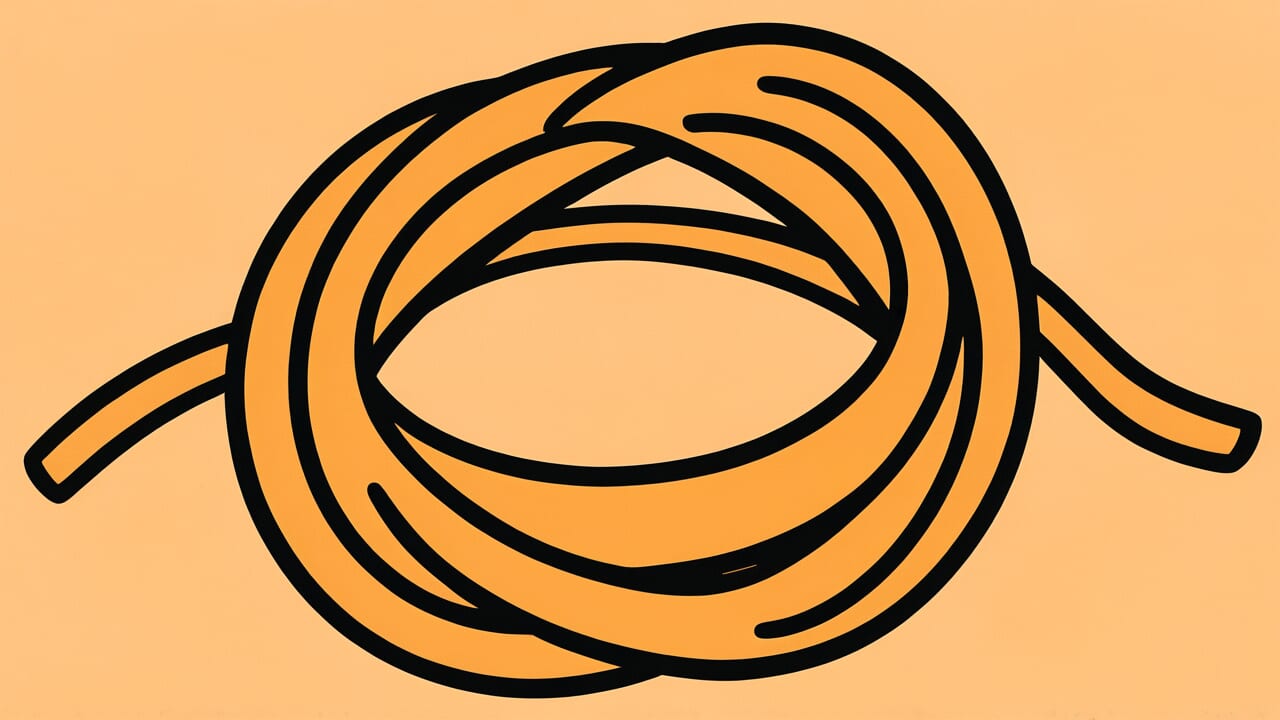

The literal image comes from trying to bring two ends of something together. Think of stretching a rope or piece of fabric until both ends can touch. In money terms, one end represents what you earn and the other represents what you spend. When both ends meet, you have just enough income to pay for everything you need.

Today we use this phrase when talking about tight budgets and careful spending. Someone might say their family is “making both ends meet” during tough financial times. It suggests they have enough money for necessities but not much extra. The phrase often describes people working hard to stay financially stable without going into debt.

What makes this saying interesting is how it captures the balancing act of everyday life. It acknowledges that many people live right at the edge of their means. The phrase doesn’t suggest wealth or poverty, just the common experience of managing limited resources carefully. Most people can relate to times when making both ends meet required planning and effort.

Origin and Etymology

The exact origin of this phrase is unknown, but it appears to have developed in English during the 1600s and 1700s. Early versions sometimes used “make both ends of the year meet,” specifically referring to annual budgets. The saying reflected the common challenge of stretching resources through an entire year.

During this historical period, most people lived much closer to financial uncertainty than today. Seasonal work, crop failures, and economic instability made budgeting a survival skill. Households often had to carefully plan how to make their income last from harvest to harvest or from one payment to the next.

The phrase spread through everyday conversation as people shared the universal experience of financial management. Over time, it shortened from the longer “year” version to simply “making both ends meet.” The saying became common in both British and American English, appearing in literature and newspapers by the 1800s as a widely understood expression for financial balance.

Interesting Facts

The word “meet” in this context uses an older meaning of “to come together” or “to join,” rather than the modern sense of encountering someone. This usage appears in other old phrases like “when two roads meet.”

Early versions of this saying sometimes referred to “the two ends of the year” rather than just “both ends.” This longer form made the financial meaning more obvious, as it clearly referred to making money last from January to December.

The phrase uses a physical metaphor that people could easily visualize, which helped it stick in memory. Many proverbs about money use similar concrete images to represent abstract financial concepts.

Usage Examples

- Accountant to client: “With your new budget plan, your income will cover all expenses – both ends meet.”

- Mother to daughter: “If you take that part-time job while studying, you’ll manage your bills without debt – both ends meet.”

Universal Wisdom

This proverb reveals a fundamental tension in human existence between our desires and our limitations. Throughout history, people have faced the challenge of finite resources meeting infinite wants. The wisdom recognizes that most human life involves this careful balancing act, where survival and stability require constant attention to the relationship between what comes in and what goes out.

The deeper truth here touches on something psychologists call “resource scarcity,” a condition that shaped human evolution for thousands of years. Our ancestors who could successfully manage limited resources were more likely to survive and thrive. This created mental patterns that persist today, even in abundance. The anxiety about making ends meet reflects ancient survival instincts that helped our species navigate uncertainty and seasonal changes.

What makes this wisdom universal is how it acknowledges the reality that perfect abundance is rare. Even wealthy individuals and societies face versions of this challenge, whether with time, energy, or other limited resources. The proverb captures the human experience of living within constraints while trying to meet our needs and goals. It suggests that the ability to balance resources isn’t just a practical skill but a fundamental part of the human condition that connects us across time and circumstances.

When AI Hears This

Humans naturally become living balance machines when money gets tight. They start making tiny daily choices without thinking about it. A person might walk instead of driving, or cook more meals at home. These small changes happen automatically, like breathing. The brain creates invisible rules that guide spending decisions. Most people don’t realize they’re running complex calculations all day long.

This automatic balancing happens because humans are wired for survival. The mind treats money shortages like any other threat to safety. It activates the same systems that help regulate body temperature or hunger. People develop personal early warning signals for financial trouble. They sense when to cut back before problems get serious. This mental thermostat works even when people aren’t paying attention to it.

What amazes me is how perfectly this system works without instruction manuals. No one teaches children how to automatically adjust their wants to match reality. Yet almost everyone learns this invisible skill naturally. The human brain solves incredibly complex resource puzzles every single day. It makes thousands of micro-decisions that somehow add up to survival. This unconscious genius for balance is truly remarkable to observe.

Lessons for Today

Understanding this wisdom begins with recognizing that resource management is a skill that improves with practice and attention. The phrase suggests that making ends meet isn’t just about having enough money, but about developing the awareness to see the relationship between income and expenses clearly. This awareness often requires tracking both sides of the equation and making conscious choices about priorities.

In relationships and families, this wisdom becomes about communication and shared responsibility. When everyone understands the financial picture, making ends meet becomes a team effort rather than one person’s burden. It involves honest conversations about needs versus wants and finding creative solutions that work for everyone involved. The phrase reminds us that financial stability often requires cooperation and mutual understanding.

For communities and organizations, this principle scales up to budgeting and resource allocation that serves the common good. Groups that successfully make ends meet often do so by involving members in understanding both the resources available and the expenses required. This creates shared ownership of financial decisions and helps everyone contribute to solutions. The wisdom suggests that sustainable success comes from this kind of balanced awareness, whether in personal life, relationships, or larger communities. While making ends meet can feel restrictive, it often leads to creativity, cooperation, and a deeper appreciation for what we have.

Comments